Authorisation

ACCOUNT PROVIDER GUIDE

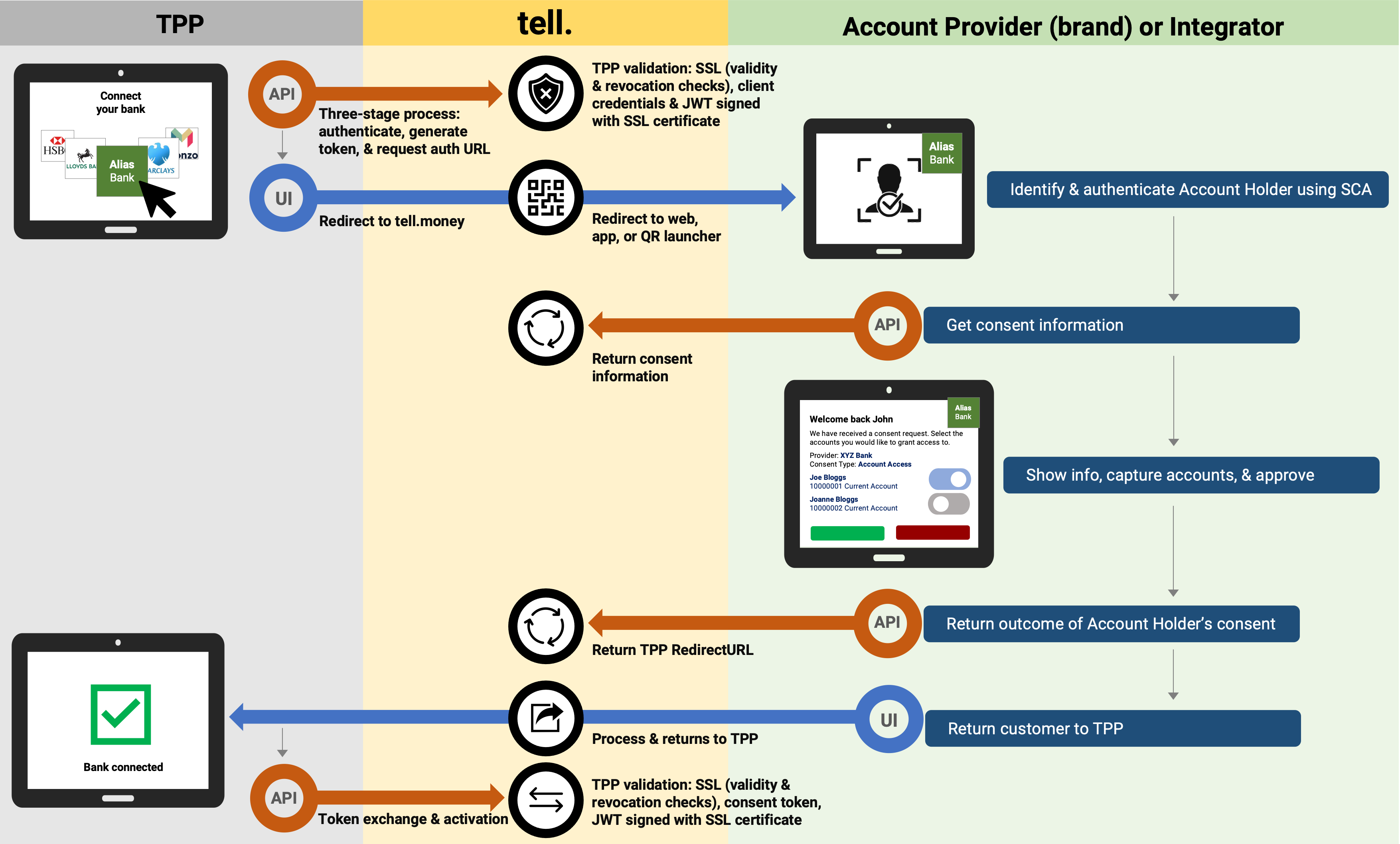

This section describes the standard journey for authorising an Account Holder consent. Contact us if you would like to discuss customised or outsourced alternatives.

Consent Flow

Initiation

To access account data or or initiate a payment on behalf of an Account Holder, a Third Party Provider starts by initiating a consent. The Third Party Provider calls the **tell.**gateway API to verify its credentials and permissions, generate a consent request, and obtain an authorisation URL (we take care of all of that – no action required by you). With a valid request in place, the Account Holder is redirected to Authorisation Service URL you have configured for the Gateway (see Configuration for more information).

Your Implementation

To implement Authorisation you will need to build an Authorisation Service, or adapt an existing part of your application, as described in the process steps below.

1. Extract ConsentId

When the Account Holder arrives at your Authorisation Service you should begin by extracting the ConsentId from the querystring.

For example, if your Authorisation Service is located at:

https://your-bank.com/tell-gatewaythen the Account Holder will be redirected to:

https://your-bank.com/tell-gateway?ConsentId={ConsentId}&CallbackURL={CallbackURL} so you will need to extract the value of ConsentId. Store this locally within your application as you will need to use it in a moment.

CallbackURL Path ParameterThis is only used in the event you're unable to retrieve a valid location from the Post Result step towards the end of this process, so that you will always have a location to redirect the user back to.

Navigating to the CallbackURL will automatically decline the consent request.

2. Authenticate (SCA)

The **tell.**gateway service is never aware of who an Account Holder is. We do not receive, process or store any customer information for reasons of security and confidentiality. At this stage in the process, the Account Holder has not yet authenticated themselves, so now that they have arrived at your application, you should perform SCA checks to authenticate and verify the identity of the individual.

3. Get Consent Information

Next, call the GET /consent/{ConsentId} endpoint using the ConsentId. This will return all data associated with the consent. See API ↗.

You can use this call at any time to retrieve data relating to a Consent. However at this stage in the process you should only proceed if the ConsentStatus is AwaitingAuthorisation.

Response:

Field | Data Type | Description & Options |

|---|---|---|

ConsentId | String | ConsentId as per the requested resource |

Environment | String | Indicates the environment in which the Consent was created.

|

GatewayId | String | UUID of your Gateway |

GatewayDomain | String | Domain name of your Gateway |

TppName | String | Name of the TPP through which the Consent originated |

TppWebsite | String | Website of the TPP through which the Consent originated |

AppName | String | Name of the TPP’s App – a TPP may have multiple apps |

AppDescription | String | Description of the TPP’s App |

AppWebsite | String | Website of the TPP’s App |

ConsentStatus | String |

|

Scope | String |

|

ConsentedAccounts | Array[String] | Array of Account IDs associated with the consent. This will be |

ConsentedUserId | String | User ID associated with the consent. This will be |

PaymentType | String | For payments, this field indicates the type of payment being consented to. OBIE:

|

Permissions (OBIEOnly) | Array[String] | For accounts, this field will be populated with an array of permissions that the Consent relates to (you do not need to handle this any differently based on the list of Permissions as we take care of that, you just need to display this to the account holder, so they are fully aware of what they are consenting to)

|

Permissions (NextGenPSD2Only) | Object | For accounts, this field will be populated with an array of objects. The field name of the array denotes the level of access for the account provided within the array. This will be any one of the following:

|

PaymentInformation | Object | If the scope is payments, this field contains an object with details of the payment being requested. The schema and examples of PaymentInformation can be found below. |

ConsentRequestCreated | String | Date & time (UTC) that the consent request was created (NB this relates to the consent request, not the consent itself – a consent request must be completed within a defined period for security reasons) |

ConsentRequestExpiry | String | Date & time (UTC) that the consent request expires (or expired) |

ConsentGranted | String | Date & time (UTC) that the consent was granted (this will be null when you make an initial check prior to carrying out SCA) |

ConsentExpiry | String | Date & time (UTC) that the consent expires / expired (this will be null when you make an initial check prior to carrying out SCA) |

ConsentRevoked | String | Date & time (UTC) that the consent was revoked by the account holder (this will be null when you make an initial check prior to carrying out SCA or if the consent has not been revoked) |

4. Show consent & Approval

Using the data returned above, you should present the Account Holder with a page displaying the information and prompting them to review and accept / reject it.

For OBIE, the permissions provided will be for the consent itself. This means the Account Holder will be granting these permissions to all accounts selected during the authorisation process. You will need to allow the Account Holder to select which accounts they would like to grant access to.

For NextGenPSD2, the permissions provided will be mapped against an account rather than against a consent as a whole. The accounts and their permissions will have already been provided when the Third Party Provider generates the consent, supplied by the PSU. In this instance, the PSU will be confirming the information supplied during the consent, therefore no account selection is required.

❯ Account Information

If the scope is accounts, you should present the Account Holder with a list of all accounts that they have access to and allow them to select one or more. This allows us to tie the consent to a specific set of accounts and allows the account holder to limit the access. If they only have one account then you do not need to display this list, but you will still need to provide us with the AccountId in the next stage.

❯ Payment Initiation & Funds Confirmation

If the request is for a payment or fundsconfirmation, you should also present the Account Holder with a list of accounts, but they may only select one account from the list. This indicates the accounts from which the payment will be debited, or against which the confirmation of funds will be performed.

If the request is for a payment, please ensure that you display the full PaymentInformation object so the account holder can review and verify that the details are correct. At this stage you can optionally verify that you would accept this payment, but this is not essential. You should not execute the payment at this stage (that will come later).

5. Post Result

After completing the authentication process, send the outcome to our POST /consent endpoint. This allows you to indicate if the request was successful (or not) and to provide a UserId and Accounts array.

A UserId can be any id from your system which we will use to identify that account holder in the future.

ForNextGenPSD2 gateways, you will need to also provide AccountIdMap array. This must strictly match the Permissions details returned in GET /consent/{ConsentId} with the ResourceId attached. For payments, an additional process is made where we make a POST /payment request to your Resource API. You will need to implement this resource first.

See API ↗ for full details.

Request

Field | Description |

|---|---|

ConsentId | ConsentId as per the requested resource |

Outcome | Indicates if the account holder authentication has been successful and the consent has been accepted (“Pass”) or if either the authentication has failed, or the account holder has rejected the consent request (“Fail”).

|

UserId | Mandatory if Outcome is Pass. A unique ID for your account holder. This is the ID we will use in future interaction to request access to resources or to initiate a payment. We treat this as a string so can be in any format |

Accounts | Mandatory if Outcome is Pass. An array of AccountIds which the account holder has approved for the consent. If the request is for a payment or fundsconfirmation, there must only be one account provided in the array. An AccountId is an identifier known to the account holder. This value (or values) will be stored by Tell against the consent and will be used to pre-validate any requests against the Consent. We treat an AccountId as a string so can be in any format |

AccountIdMap | Mandatory if usingNextGenPSD2 Not applicable if usingOBIE An array of resource IDs identifiable to yourselves, matched against the account identifiers that the PSU has provided consent for. N.B. Only the account identifiers provided in the consent can be provided in this array. All resource IDs in this array must match the account IDs provided in the |

Response:

| Field | Description |

|---|---|

| Location | If applicable, this will contain a URL to which you should redirect the account holder (see Wrap up for details) |

6. Wrap up

On completion of the step above, you will have received a response value of Location.

If this field is populated with a URL, you should redirect the account holder back to the URL provided. If value is "na" then no need to do anything - just display a friendly "all done" message and prompt the account holder to go back to the third party provider site to continue their journey. This variation is designed to support different journeys i.e. if the account holder began on a different device.

Permission Code Definitions

OBIE Permissions

| Code | Resource | Definition |

|---|---|---|

| ReadAccountsBasic | GET /account(s) | The TPP can make requests and will not see identifiable details of an account nor its account servicer. |

| ReadAccountsDetail | GET /account(s) | The TPP can make requests and will see identifiable details of an account and its account servicer. |

| ReadBalances | GET /balance | The TPP can make requests and read balances. |

| ReadBeneficiariesBasic | GET /beneficiaries | The TPP can make requests and will not see identifiable details of a beneficiary account nor its account servicer. |

| ReadBeneficiariesDetail | GET /beneficiaries | The TPP can make requests and will see identifiable details of a beneficiary account and its account servicer. |

| ReadDirectDebits | GET /direct-debits | The TPP can make requests and read direct debits. |

| ReadScheduledPaymentsBasic | GET /direct-debits | The TPP can make requests and will not see identifiable details of a creditor account nor its account servicer. |

| ReadScheduledPaymentsDetail | GET /scheduled-payments | The TPP can make requests and will see identifiable details of a creditor account and its account servicer. |

| ReadTransactionsBasic | GET /transactions | The TPP can make requests and will not see the balance, merchant details, creditor accounts, and debtor accounts. |

| ReadTransactionsDetail | GET /transactions | The TPP can make requests and will see balance, merchant details, creditor accounts, and debtor accounts. |

| ReadTransactionsCredits | GET /transactions | The TPP can make requests and will see credit transactions. |

| ReadTransactionsDebits | GET /transactions | The TPP can make requests and will see debit transactions. |

| ReadStatementsBasic | GET /statements | The TPP can make requests and will not see statement amounts. |

| ReadStatementsDetail | GET /statements | The TPP can make requests and will see statement amounts. |

| ReadStandingOrdersBasic | GET /standing-orders | The TPP can make requests and will not see creditor accounts. |

| ReadStandingOrdersDetail | GET /standing-orders | The TPP can make requests and will see creditor accounts. |

NextGenPSD2 Permissions

| Code | Resource | Definition |

|---|---|---|

| accounts | GET /account(s) | The TPP can make requests and will see all data including identifiable details of an account and its account servicer. |

| transactions | GET /transactions | The TPP can make requests and will see all data including balance, merchant details, creditor accounts, and debtor accounts. |

| balances | GET /balance | The TPP can make requests and read balances. |

Payment Information Schemas

OBIE (All PIS Payments)

Specification

Field | Data Type | Used Where Payment Type Is | Description & Options |

|---|---|---|---|

InstructionIdentification | String | All Payment Types | Unique identification as assigned by an instructing party for an instructed party to unambiguously identify the instruction |

EndToEndIdentification | String | All Payment Types | Unique identification assigned by the initiating party to unambiguously identify the transaction. This identification is passed on, unchanged, throughout the entire end-to-end chain |

InstructedAmount/Amount | String |

| The amount due to be paid expressed as number with two or three decimal points e.g. 12.34 |

InstructedAmount/Currency | String |

| Payment currency of debtor in ISO 4217 three-letter code format |

CreditorAccount/SchemeName | String | All Payment Types |

|

CreditorAccount/Identification | String | All Payment Types | Identification of the creditor account. Format is dependent on SchemeName |

CreditorAccount/Name | String | All Payment Types | Name of the creditor account |

CurrencyOfTransfer | String |

| Payment currency of creditor in ISO 4217 three-letter code format |

RequestedExecutionDateTime | String |

| Date at which the requestor would like the payment to be made |

Frequency | String |

| Frequency of the standing order See Resources for details |

FirstPaymentDateTime | String |

| The date on which the first payment for a Standing Order schedule will be made in ISODateTime format. |

FirstPaymentAmount/Amount | String |

| The amount of the first Standing Order. This field will not always be provided |

FirstPaymentAmount/Currency | String |

| The currency of the first Standing Order in ISO 4217 three-letter code format. This field will only be provided if FirstPaymentAmount is present |

RecurringPaymentAmount/Amount | String |

| The amount of the recurring Standing Order expressed as number with two or three decimal points e.g. 12.34 |

RecurringPaymentAmount/Currency | String |

| The currency of the recurring Standing Order in ISO 4217 three-letter code format |

RemittanceInformation/Reference | String |

| Reference to enable the matching/reconciliation of an entry with the items that the payment is intended to settle. The TPP may not provide one. |

Domestic Payment Examples

"PaymentInformation": {

"InstructionIdentification": "c3f57611-58db-4f99-b5b4-d055f3",

"EndToEndIdentification": "cd8bf3cf-a016-4281-803a-91c4d6",

"InstructedAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

}

}"PaymentInformation": {

"InstructionIdentification": "d59b1fe6-e3b0-4278-9677-915303",

"EndToEndIdentification": "1c23ab00-a788-4a04-bf37-96ce1b",

"InstructedAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

},

"RequestedExecutionDateTime": "2023-07-21T11:20:21+00:00"

},"PaymentInformation": {

"InstructionIdentification": "5c861bad-9adf-443a-87dc-ce5880",

"EndToEndIdentification": "b9da5c36-e34c-43ea-9777-2432f3",

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

},

"Frequency": "EvryDay",

"FirstPaymentDateTime": "2023-07-21T11:20:21+00:00",

"FirstPaymentAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"RecurringPaymentAmount": {

"Amount": "1.23",

"Currency": "GBP"

}

},International Payment Examples

"PaymentInformation": {

"InstructionIdentification": "c3f57611-58db-4f99-b5b4-d055f3",

"EndToEndIdentification": "cd8bf3cf-a016-4281-803a-91c4d6",

"InstructedAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

},

"CurrencyOfTransfer": "EUR"

}"PaymentInformation": {

"InstructionIdentification": "154b7d24-e75f-4ba9-b641-379481",

"EndToEndIdentification": "137eb1a3-bd8a-4a2e-8d3d-8c32ea",

"InstructedAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

},

"CurrencyOfTransfer": "EUR",

"RequestedExecutionDateTime": "2023-07-21T11:20:21+00:00"

},"PaymentInformation": {

"InstructionIdentification": "c769b34c-ea75-4257-8a7b-efbe8e",

"EndToEndIdentification": "6d61a958-b811-455a-bcd0-dd213f",

"InstructedAmount": {

"Amount": "1.23",

"Currency": "GBP"

},

"CreditorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Name": "Joe Bloggs",

"Identification": "12345612345678"

},

"CurrencyOfTransfer": "EUR",

"Frequency": "EvryDay",

"FirstPaymentDateTime": "2023-07-21T11:20:21+00:00"

},OBIE - (CBPII Funds Confirmation)

This is a specification of the PaymentInformation when the consent type is of "fundsconfirmation". Note: CBPII Funds Confirmation service is separate to PIS.

Specification

Field | Data Type | Required? | Description & Options |

|---|---|---|---|

ExpirationDateTime | String | No | Specified date and time the funds confirmation authorisation will expire. If this is not populated, the authorisation will be open ended. |

DebtorAccount/Identification | String | Yes | Identification of the account. Format is dependent on SchemeName. |

DebtorAccount/Name | String | No | Name of the account. |

DebtorAccount/SchemeName | String | Yes |

|

DebtorAccount/SecondaryIdentification | String | No | This is secondary identification of the account, as assigned by the account servicing institution. This can be used by building societies to additionally identify accounts with a roll number (in addition to a sort code and account number combination). |

Example

"DebtorAccount": {

"SchemeName": "UK.OBIE.SortCodeAccountNumber",

"Identification": "12345612345678"

}NextGenPSD2

Specification

***** Account identifier for creditorAccount and debtorAccount will be one of iban, bban, or msisdn.

Field | Data Type | Used Where Payment Type Is | Description & Options |

|---|---|---|---|

endToEndIdentification | String | Optional for:

| Unique identification as assigned by an instructing party for an instructed party to unambiguously identify the instruction. |

instructedAmount/currency | String | All Payment Types | Payment currency of debtor in ISO 4217 three-letter code format. |

instructedAmount/amount | String | All Payment Types | The amount given with fractional digits, where fractions must be compliant to the currency definition. Up to 14 significant figures. The decimal separator is a dot. Pattern: |

debtorAccount/iban***** | String | All Payment Types | IBAN of the debtor account. |

debtorAccount/bban***** | String | All Payment Types | Basic Bank Account Number (BBAN) of the debtor account. Identifier used nationally by financial institutions, i.e., in individual countries, generally as part of a National Account Numbering Scheme(s), which uniquely identifies the account of a customer. |

debtorAccount/msisdn***** | String | All Payment Types | Mobile Station International Subscriber Directory Number (MSISDN) of the debtor account. Unique number that identifies a mobile subscriber. |

creditorAccount/iban***** | String | All Payment Types | IBAN of the creditor account. |

creditorAccount/bban***** | String | All Payment Types | Basic Bank Account Number (BBAN) of the creditor account. Identifier used nationally by financial institutions, i.e., in individual countries, generally as part of a National Account Numbering Scheme(s), which uniquely identifies the account of a customer. |

creditorAccount/msisdn***** | String | All Payment Types | Mobile Station International Subscriber Directory Number (MSISDN) of the creditor account. Unique number that identifies a mobile subscriber. |

creditorAgent | String | Optional for:

| BICFI. Pattern: |

creditorName | String | Optional for:

| Name of the creditor account. |

creditorAddress | String | Optional for:

| Address of the creditor account. |

chargerBearer | Optional for:

|

| |

remittanceInformationUnstructured | String | Optional for:

| Unstructured remittance information. |

Updated 6 months ago